UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

OLLIE’S BARGAIN OUTLET HOLDINGS, INC. |

(Name of Registrant as Specified in its Charter) |

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

☒ | | | No fee required. |

☐ | | | Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

OLLIE’S BARGAIN OUTLET HOLDINGS, INC.

6295 Allentown Boulevard, Suite 1

Harrisburg, Pennsylvania 17112

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 15, 202313, 2024 at 10:00 a.m. local time

To our Stockholders,

Notice is hereby given that the 20232024 Annual Meeting of Stockholders of Ollie’s Bargain Outlet Holdings, Inc. (“Annual Meeting”) will be held on June 15, 2023,13, 2024, at 10:00 a.m. local time at the Colonial Golf and Tennis Club, 4901 Linglestown Road, Harrisburg, PA 17112 to:

| 1. | Elect |

| 2. | Approve a non-binding advisory proposal regarding named executive officer compensation; |

| 3. | Approve a non-binding advisory proposal regarding the frequency of holding a non-binding advisory vote regarding the Company’s named executive officer compensation, beginning with the Next Annual Meeting; and |

| Ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending February |

We will also consider any other matters that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

Our Board of Directors has fixed the close of business on April 17, 2023,2024, as the record date (“Record Date”) for the determination of stockholders entitledeligible to receive notice of and to vote at our Annual Meeting, and any adjournments or postponements thereof.

To reduce the environmental impact and cost of our Annual Meeting, we have elected to provideare providing access to proxy materials overelectronically through the internet electronically underpursuant to the Securities and Exchange Commission’s (the “SEC”) “notice and access” rules. However, if you prefer to receive paper copies of our annual proxy materials, please follow the instructions included in the Notice of Internet Availability.

To be admitted to the Annual Meeting, you must present proof of stock ownership as of the record dateRecord Date and a valid photo identification. Please follow the procedures described on page 3 of the proxy statement.

Your vote is important. We encourage you to vote by proxy in advance of the Annual Meeting, whether or not you plan to attend.

BY ORDER OF THE BOARD OF DIRECTORS | | | |

| | | |

James J. Comitale | | | |

Senior Vice President, General Counsel and Corporate Secretary | | | |

May 2, 2024 | | |

| | | 2024 PROXY STATEMENT i |

OLLIE’S BARGAIN OUTLET HOLDINGS, INC.

6295 Allentown Boulevard, Suite 1

Harrisburg, Pennsylvania 17112

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

June 15, 202313, 2024

The Board of Directors (the “Board”) of Ollie’s Bargain Outlet Holdings, Inc. (“Ollie’s,” “we,” “us,” “our,” or the “Company”) is soliciting your proxy to be voted at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 15, 2023,13, 2024, at 10:00 a.m. local time at the Colonial Golf and Tennis Club, 4901 Linglestown Road, Harrisburg, PA 17112, and any postponement or adjournment thereof.

Matters Considered at the Annual Meeting

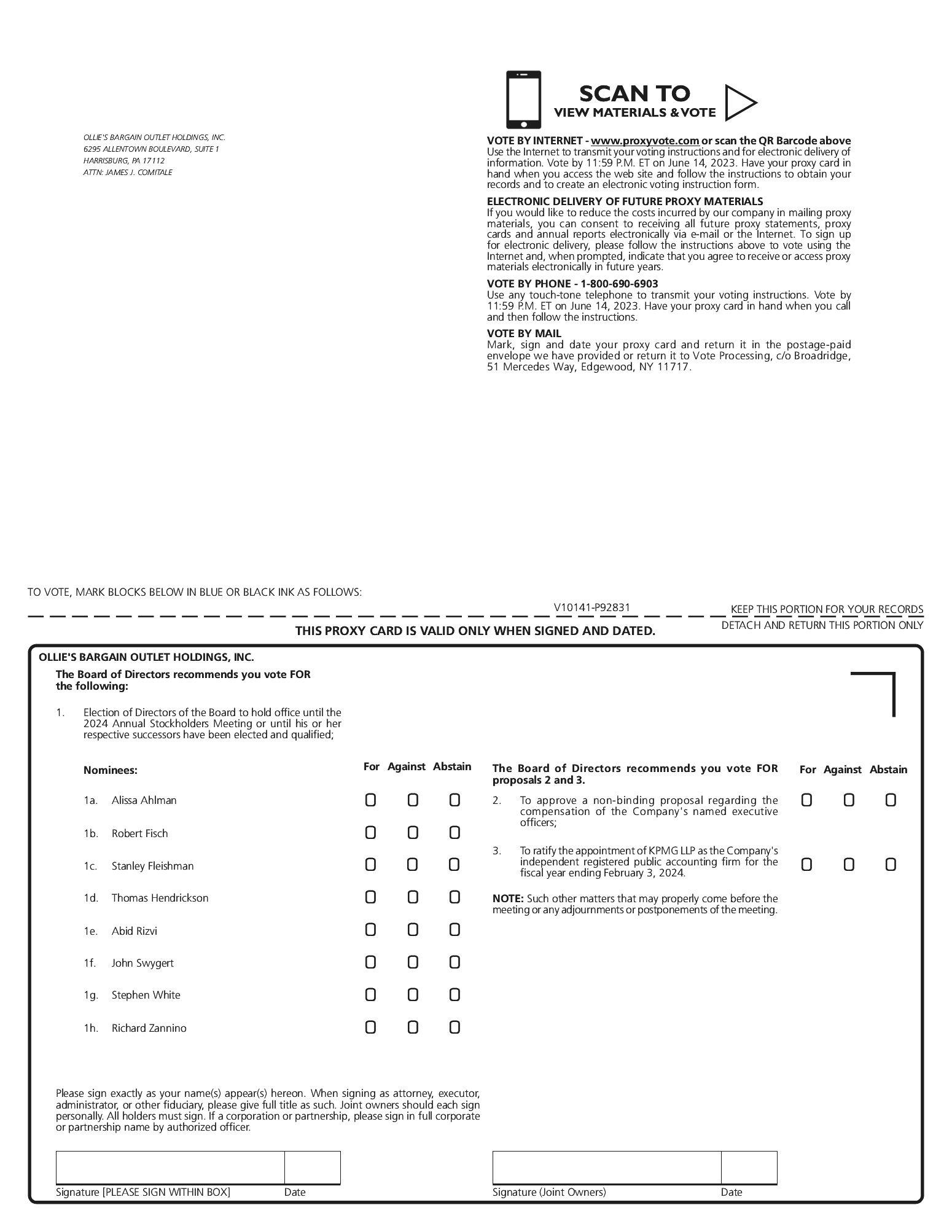

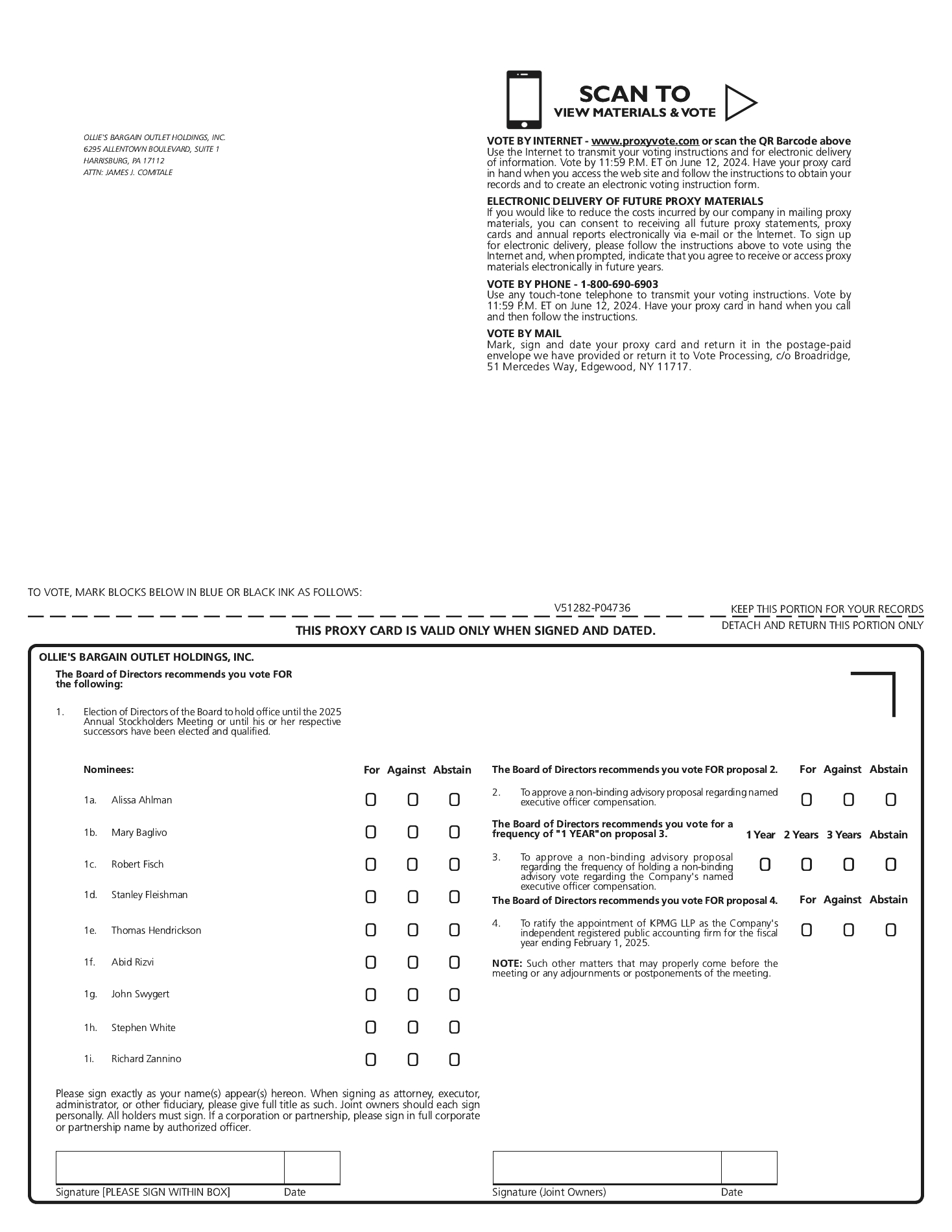

At the Annual Meeting, stockholders will be asked to vote to: (1) elect eightnine nominees named herein as directors to hold office until the 2024 annual meeting;Next Annual Meeting; (2) approve a non-binding advisory proposal regarding the compensation of named executive officers (“Named Executive Officer(s)” or “NEO(s)”); (3) approve a non-binding proposal regarding the frequency of holding an advisory vote on the compensation of NEOs; and (3)(4) ratify the appointment of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for the current fiscal year ending February 3, 2024.1, 2025 (“Fiscal 2024”). The Board is not aware of any matters to be brought before the Annual Meeting other than as set forth in the notice of meeting. If any other matters properly come before the Annual Meeting, the persons named in the enclosed form of proxy, or their substitutes will vote in accordance with their best judgment on such matters.

Record Date; Stock OutstandingOutstanding; and Entitled to Vote

Holders of common stock as of the record date, which was the close of business on April 17, 2023,the Record Date, are entitled to notice of, and to vote at, the Annual Meeting. As of the record date, there were 61,897,33361,291,151 shares of common stock outstanding and entitled to vote at the Annual Meeting, with each share entitled to one vote.

Important Notice of Internet Availability Proxy Materials

Under the “notice and access” rules adopted by the Securities and Exchange Commission (the “SEC”),SEC, we are furnishing Proxy Materials as defined on page 2 of this Proxy Statement to most of our stockholders onthrough the internet, rather than mailing printed copies. By doing so, we save costs and reduce our impact on the environment. If you received a Notice of Internet Availability by mail, you will not receive printed copies of the Proxy Materials unless you request them. Instead, thethem in writing. The Notice of Internet Availability will instruct you how to access and review the Proxy Materials on the internet. If you would like printed copies of the Proxy Materials, please follow the instructions on the Notice of Internet Availability. The Notice of Internet Availability was first mailed on or before May 5, 2023,2, 2024, to all stockholders of record as of the record dateRecord Date for the Annual Meeting.

Participating in the Annual Meeting; Admission

If you are a stockholder of record, you will need to present the Notice of Internet Availability or proxy card that you received, together with a form of personal photo identification, in order to be admitted into the Annual Meeting. If you are the beneficial owner of shares held in “street name,”name” as of the close of business on the

| | | 2024 PROXY STATEMENT 1 |

Record Date, you will need to provide proof of ownership, such as a recent account statement or letter from your bank, broker, or other nominee, as of the close of business on April 17, 2023, along with a form of personal photo identification. Alternatively, you may contact the broker, bank, or other nominee in whose name your shares of common stock are registered and obtain a legal proxy to bring to the Annual Meeting.

Our “Proxy Materials” include:

This Proxy Statement;

A Notice of our Annual Meeting (which is attached to this Proxy Statement); and

Our 20222023 Annual Report to Stockholders.

If you received printed versions of these materials by mail (rather than through electronic delivery), these materials also include a Proxy Card or voting instruction form. If you received or accessed these materials through the internet, your Proxy Card or voting instruction form are available to be filled out and executed electronically. You should review thethis entire Proxy Statement and the 20222023 Annual Report to Stockholders before you vote.

Quorum; Shares Held by Brokers

The presence at the Annual Meeting, in person or by proxy, of the holders of at least a majority of the number of shares of common stock issued, and outstanding, and entitled to vote as of the record date,Record Date, is required to constitute a quorum to transact business at the Annual Meeting.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by broker non-votes (as defined below) also are counted as present and entitled to vote for purposes of determining a quorum.

If you are the beneficial owner of shares held for you by a broker, your broker must vote those shares in accordance with your instructions. If you do not give voting instructions to your broker, your broker may vote your shares for you on any discretionary items of business to be voted upon at the Annual Meeting. If your broker does not receive instructions from you on how to vote your shares on aany non-discretionary item of business, then the broker will not be able to vote your shares, which is known as a “broker non-vote.” The appointment of KPMG (Proposal 3)4) is considered a discretionary item, and brokers may vote on behalf of beneficial owners who have not furnished voting instructions on this discretionary item. Brokers cannot vote on any of the other proposals contained in this Proxy Statement, which are considered “non-routine” or non-discretionary proposals,items of business, unless they have received voting instructions from the beneficial owner, and to the extent that they have not received such voting instructions, brokers report such number of shares as “non-votes.”

Required Votes on Proposals

Election of Directors. Proposal 1. The affirmative vote of the holders of a majority of the votes cast with respect to the director at the Annual Meeting is required to elect each nominee named herein as a director. Abstentions and broker non-votes will have no effect on this nondiscretionary proposal.

Non-Binding Advisory Vote to Approve Named Executive Officer Compensation.Proposal 2. The affirmative vote of the majority of shares present in person or represented by proxy and voting on the subject matter at the Annual Meeting is required to approve this item.nondiscretionary proposal. Abstentions count as a vote “against”, and broker non-votes will have no effect on this proposal.

Non-Binding Advisory Vote Regarding the Frequency of Holding an Advisory Vote Regarding the Named Executive Officer Compensation.Proposal 3. At the Annual Meeting, the Company’s stockholders will be asked through an advisory vote whether future votes regarding NEO compensation should occur every year, every two years, or every three years. The frequency option that receives the greatest number of affirmative votes of shares present in person or represented by proxy and voting on the proposal at the Annual Meeting will be approved on

2 2024 PROXY STATEMENT | | |  |

a non-binding, advisory basis (meaning that of the total votes of all shares represented at the Annual Meeting and entitled to vote, the frequency option that receives the most votes (even if not a majority) will be approved on a non-binding, advisory basis). This is a nondiscretionary proposal. Abstentions and broker non-votes will have no effect on this proposal.

Ratification of the Selection of KPMG.Proposal 34, relating to the. The ratification of the selection of KPMG as our independent registered public accounting firm for theour fiscal year ending February 3, 2024,1, 2025, will be approved if it receives the affirmative vote of the majority of shares present in person or represented by proxy at a meeting and voting on the subject matter.this proposal. This proposal is a discretionary item,proposal, and brokers may vote on behalf of beneficial owners who have not furnished voting instructions on this item. Abstentions will count as a vote against this proposal.

Other Matters. If any other matters are properly presented at the Annual Meeting for action, including a question of adjourning or postponing the Annual Meeting from time to time, the persons named in the proxies and acting thereunder will have discretion to vote on such matters in accordance with their best judgment.

Although the advisory votevotes in ProposalProposals 2 isand 3 are non-binding, our Board will review the results of the votevotes and will take itthem into account in making determinations concerningregarding our Named Executive Officer compensation and the frequency of future votes regarding Named Executive Officer compensation.

The vote on each matter submitted to the stockholders is tabulated separately. Broadridge Financial Solutions, or a representative thereof, will tabulate the votes.

Stockholders of record are requested to vote by proxy in one of four ways:

| • | By telephone - Use the toll-free telephone number shown on the Notice of Internet Availability or any proxy card you receive; |

| • | By internet - Visit the internet website indicated on the Notice of Internet Availability or any proxy card you receive and follow the on-screen instructions; |

| • | By mail - If you request a paper proxy card by telephone or internet, you may elect to vote by mail. If you elect to do so, you should date, sign, and promptly return your proxy card by mail in the postage prepaid envelope which accompanied that proxy card; or |

| • | In person - You can deliver a completed proxy card at the Annual Meeting or vote in person. |

Voting instructions (including instructions for both telephonic and internet proxies) are provided on the Notice of Internet Availability and on any proxy card you receive. The internet and telephone proxy procedures are designed to authenticate stockholder identities, to allow stockholders to give voting instructions, and to confirm that stockholder instructions have been recorded properly. A control number, located on the Notice of Internet Availability, or proxy card, will identify stockholders, and allow them to submit their proxies and confirm that their voting instructions have been properly recorded. Costs associated with electronic access, such as usage charges from internet access providers and telephone companies, must be borne by the stockholder. If you submit your proxy by internet or telephone, it will not be necessary to return a proxy card for your vote to be counted.

If a stockholder does not submit a proxy by the internet or by telephone or return a signed proxy card and does not attend the Annual Meeting and vote in person, his or her shares will not be voted. Shares of our common stock represented by properly executed proxies received by us or proxies submitted by telephone or via the internet, which are not revoked, will be voted at the Annual Meeting in accordance with the instructions contained therein.

If instructions are not given and you do not indicate how your shares should be voted on a proposal, the shares represented by a properly completed proxy will be voted as the Board recommends. In addition, we reserve the right to exercise discretionary authority to vote proxies, in the manner determined by the Company in its sole discretion, on any matters brought before the Annual Meeting for which we did not receive adequate notice under the proxy rules promulgated by the SEC.

| | | 2024 PROXY STATEMENT 3 |

Any proxy signed and returned by a stockholder or submitted by telephone or via the internet may be revoked at any time before it is exercised by giving written notice of revocation to the Company’s Secretary at our address set forth herein, by executing and delivering a later-dated proxy (either in writing, by telephone, or via the internet), or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not, in and of itself, constitute revocation of a proxy.

If you are a stockholder who holds your shares are held in the name of a bank, broker, fiduciary, or custodian, follow the voting instructions on the form you receive from your record holder. The availability of internet and telephone proxies for these stockholders will depend on theirthe voting procedures.procedures of the bank, broker, fiduciary or custodian.

Householding

Some banks, brokers, and other holders of record may be participating in the practice of “householding” proxy statements, annual reports, or notices. This means that only one copy of our Proxy Materials or Notice of Internet Availability, as applicable, may have been sent to multiple stockholders in your household. If you want to receive separate copies of our Proxy Materials or Notice of Internet Availability, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, fiduciary, custodian or other holder of record, or you may contact James J. Comitale, Senior Vice President, General Counsel and Corporate Secretary at Ollie’s Bargain Outlet Holdings, Inc., by written request, at 6295 Allentown Boulevard, Suite 1, Harrisburg, Pennsylvania 17112.

If you own shares of our common stock in more than one account, such as individually, and also jointly with your spouse, you may receive more than one Notice of Internet Availability relating to these Proxy Materials or copy of these Proxy Materials themselves. To assist us in saving money and to serve you more efficiently, we encourage you to have all your accounts registered in the same name and address by contacting our transfer agent: American Stock Transfer &Equiniti Trust Company, LLC, 6201 15th Avenue, Brooklyn,48 Wall Street, Floor 23, New York, NY 11219,10005, Telephone: (800) 937-5449, or (718) 921-8124.401-1957.

Proxy Solicitation

The Company is paying the costs of the solicitation of proxies. Members of our Board, andCompany officers and employeesassociates, and designated agents may solicit proxies by mail, telephone, fax, email, or in person. We will not pay directors, officers, or employeesassociates any extra amounts for soliciting proxies. We may, upon request, reimburse brokerage firms, banks or similar entities representing street name holders for their expenses in forwarding Proxy Materials to their customers who are street name holders and obtaining their voting instructions.

No arrangements or contracts have been made or entered into with any solicitors as of the date of this Proxy Statement, although we reserve the right to engage solicitors if we deem them necessary. If done, such solicitations may be made by mail, telephone, facsimile, e-mail, or personal interviews.

Annual Report and Company Information

Our Annual Report to Stockholders, which contains consolidated financial statements for the fiscal year ended January 28, 2023February 3, 2024 (“Fiscal 2022”2023”), is being furnished to stockholders concurrently herewith. You also may obtain a copy of our Annual Report on Form 10-K for Fiscal 20222023 that was filed with the SEC, without charge, by writing to Ollie’s Bargain Outlet Holdings, Inc., Attn: General Counsel, 6295 Allentown Boulevard, Suite 1, Harrisburg, Pennsylvania 17112. These materials will also be available without charge at “Investor Relations” on our website at www.ollies.us.

Fiscal Year 2023 Highlights

Total net sales were $2.103 billion, an increase of 15.1% compared to the prior year, representing the first year in which the Company’s net sales exceeded $2 billion;

Comparable store sales increased 5.7% from the prior year;

We opened 45 new stores and closed one store, growing our store base 9.4% and ended the year with 512 stores in 30 states;

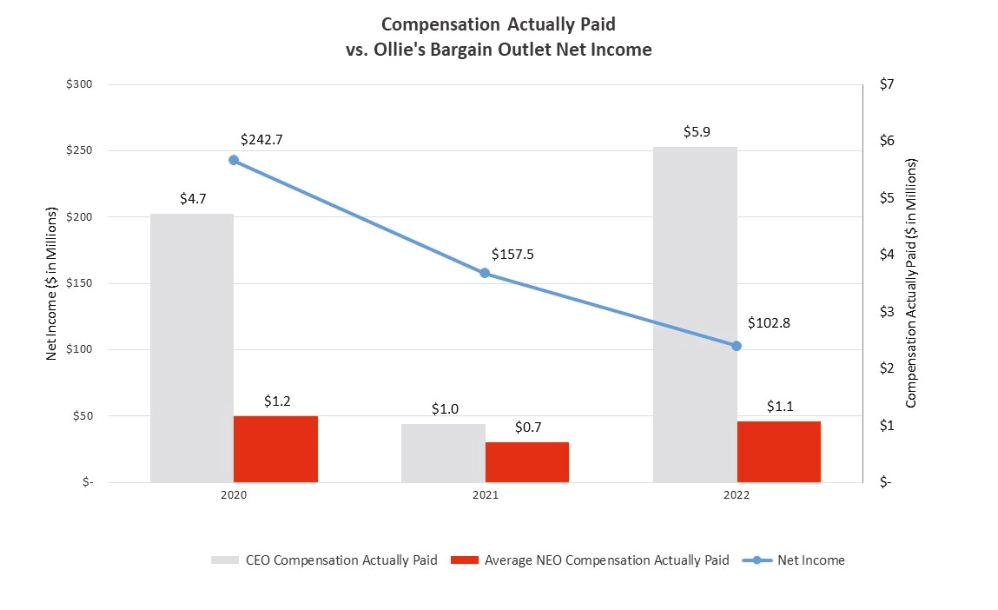

Net income totaled $181.4 million, an increase of 76.5% as compared with net income of $102.8 million, in the prior year;

4 2024 PROXY STATEMENT | | |  |

Earnings per diluted share was $2.92, an increase of 78.0% as compared with earnings per diluted share of $1.64 in the prior year; and

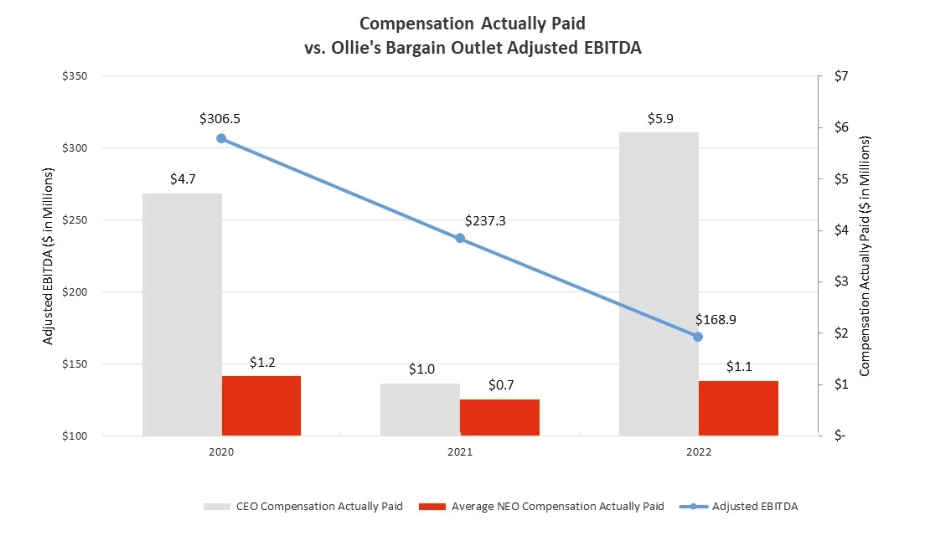

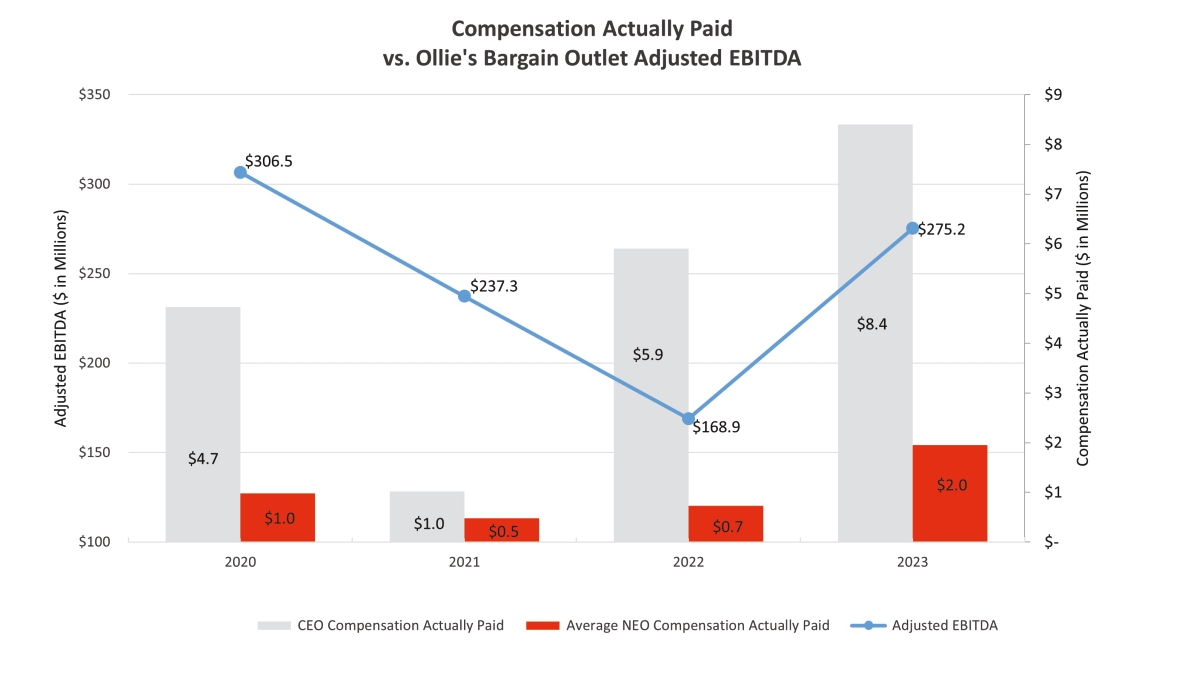

Adjusted EBITDA totaled $275.2 million an increase of 62.9% compared to the prior year.

For a discussion of Adjusted EBITDA, a non-GAAP measure, including a reconciliation to the nearest GAAP measure, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — EBITDA and Adjusted EBITDA” beginning on page 42 of our Annual Report on Form 10-K for Fiscal 2023.

In Fiscal 2023, we opened our 500th store, entered our 30th state, added a record 3.6 million new Ollie’s Army members, and returned to a pattern of consistent execution and growth. We recently completed our latest third-party real estate feasibility study, which utilizes demographic data and density across a changing U.S. landscape. The migration trend out of larger metropolitan markets into rural and suburban areas is a positive trend for Ollie’s and the study concluded that we are able to operate as many as 1,300 stores nationwide, up from a previous target of 1,050.

Stock Repurchase

Over the course of Fiscal 2022 and Fiscal 2023, we returned over $94,300,000 of value to our shareholders through the repurchase of 1,656,802 shares of the Company’s common stock, which represents 2.7% of the common stock outstanding as of the expiration of Fiscal 2023.

Our Board is committed to continued evaluation and improvement of our governance practices, including as set forth under the section of this Proxy Statement entitled “Corporate Governance Matters,” in order to serve the best interests of the Company and our stockholders.

As of the end of Fiscal 2022,2023, we are in compliance with Nasdaq’sthe Board Diversity Rule.Rule of the Nasdaq Stock Market (“Nasdaq”). We publicly disclose board-level diversity statistics using a standardized template and have at least two (2) diversethree (3) board members who self-identify as diverse, including at least one (1) femaletwo (2) board member.members who self-identify as female.

On November 29, 2022,30, 2023, our Board fixedincreased the number of directors at eightto nine and appointed Abid RizviMary Baglivo as aan independent, non-employee member of the Board.

Our Board consists of all independent, non-employee directors other than our Chief Executive Officer.

Our Board is fully declassified, and all our directors are up for election annually.

Our Board has adopted a version of the so-called “Rooney Rule,” requiring that we, or search firms we engage to recruit directors, must include qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Committee selects director candidates. Accordingly, our Nominating and Corporate Governance Committee Charter requires that the Committee include and require that any search firm that it engages includes qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Committee selects director candidates.

The Company’s Corporate Governance Guidelines and Principles reflect the Board’s commitment to consider diversity of race, ethnicity, gender, age, nationality, education, cultural background, and professional experiences in evaluating candidates.

Our Nominating and Corporate Governance Committee Charter requires that the Committee periodically review our environmental, social, and governance (“ESG”) strategy, initiatives, and policies.

We have a majority voting standard for directors in uncontested elections with a resignation policy for directors who do not receive the support of a majority of our stockholders.

Our Nominating and Corporate Governance Committee is comprisedconsists entirely of independent directors, including an independent Chair of the Committee.

Our Certificate of Incorporation does not contain any supermajority vote provisions.

All employeesassociates and directors are prohibited from hedging and pledging shares of Company stock.

| | | 2024 PROXY STATEMENT 5 |

Directors are required to notify the Board when the director’s principal occupation or business association changes substantially from the position held when the director originally joined the Board.

None of our directors currently serves on more than three other public company boards.boards of directors.

The Board and each of its committees conduct annual self-evaluations, during which Board refreshment is considered.considered and discussed.

| • | The Board annually reviews and agrees to be bound by the Company’s Code of Conduct (as defined below in “Environmental, Social and Governance and Corporate Responsibility” – “Code of Ethical Business Conduct”). |

6 2024 PROXY STATEMENT | | |  |

Our Board currently consists of eight (8)nine (9) directors. Our current Board members are Alissa Ahlman, Mary Baglivo, Robert Fisch, Stanley Fleishman, Thomas Hendrickson, Abid Rizvi, John Swygert, Stephen White, and Richard Zannino.

Our Board is fully declassified. Alissa Ahlman, Mary Baglivo, Robert Fisch, Stanley Fleishman, Thomas Hendrickson, Abid Rizvi, John Swygert, Stephen White, and Richard Zannino have been nominated for election at the Annual Meeting for a one-year term, and if elected, they are expected to stand for re-election next at our 2024 annual meeting of stockholders.Next Annual Meeting.

In selecting director candidates for election at the Annual Meeting, our Nominating and Corporate Governance Committee and our Board considered whether each candidate possesses the required skill sets and fulfilledfulfills the qualification requirements of directors approved by the Board, including independence, sound judgment, business specialization, technical skills, diversity, and other desired qualities. The following biographies describe the relevant business experience of each director and nominee.

The nominees for election as directors at the Annual Meeting are described below. The Board, upon the recommendation of the Nominating and Corporate Governance Committee, has nominated each of the candidates for election. The Board expects that each of the nominees will be available for election as a director. However, if by reason of an unexpected occurrence, one or more of the nominees is not available for election, the persons named in the form of proxy have advised that they will vote for such substitute nominees as the Board may nominate.

In the event that, in an uncontested election, any incumbent director does not receive a majority of the votes cast in his or her favor, such director will promptly tender his resignation to the Board. Following the consideration of the recommendation of the Nominating and Corporate Governance Committee, the Board will decide whether to accept or reject the tendered resignation or whether other action should be taken. The Board will disclose its explanation within 90 days from the publication of the Board election results. The Nominating and Corporate Governance Committee and the Board may consider any factor deemed appropriate in deciding whether to accept or reject the tendered resignation.

| | | 2024 PROXY STATEMENT 7 |

| | Director | | | Age | | | Tenure | | | Committee Service | |

| | Alissa Ahlman | | | | | | | Compensation Committee, Nominating and Corporate Governance Committee | | ||

| | | | | | | | Nominating and Corporate Governance Committee | | |||

| | Robert Fisch | | | 74 | | | 2015-present | | | Compensation Committee, Nominating and Corporate Governance Committee | |

| | Stanley Fleishman | | | | | | | Audit Committee, Nominating and Corporate Governance Committee (Chair) | | ||

| | Thomas Hendrickson | | | | | | | Audit Committee (Chair), Nominating and Corporate Governance Committee | | ||

| | Abid Rizvi | | | | | | | Audit Committee, Nominating and Corporate Governance Committee | | ||

| | John Swygert | | | | | | | None | | ||

| | Stephen White | | | | | | | Audit Committee, Nominating and Corporate Governance Committee | | ||

| | Richard Zannino | | | | | | | Compensation Committee (Chair), Nominating and Corporate Governance Committee | |

Alissa Ahlmanhas served as a director since May 2020. Since December 2022, Ms. Ahlman serveshas served as the Chief Merchandising Officer of the Home Furnishing Division for the Franchise Group, Inc. since December 2022. In this role, Ms. Ahlman oversees merchandising, planning, allocation, and supply chain for American Freight, Badcock Furniture, and Buddy’s Home Furnishings.Freight. Prior to the Franchise Group, Ms. Ahlman was the Chief Merchandising Officer and Chief Design Officer for At Home Group, Inc. (“At Home”), a high growth, national big-box retailer specializing in home décor, furniture, and seasonal products. Ms. Ahlman joined Garden Ridge in March 2008, prior to its rebranding to At Home in 2014. Ms. Ahlman was responsible for the merchandise transformation at At Home and was part of the executive leadership team that rebranded Garden Ridge to At Home, including its initial public offering in 2016. Ms. Ahlman held various roles in merchandising and merchandise planning until her retirement from At Home in December 2018. Before joining At Home, Ms. Ahlman served in merchandising roles at 99 Cents Only Stores LLC and Factory 2-U Stores, Inc. Ms. Ahlman’s retail, merchandising, marketing, and business experience qualify her to serve as one of our directors.

Mary Baglivo has served as a director since November 2023. Ms. Baglivo currently serves as the Chief Executive Officer of the Baglivo Group, a strategy consulting company. Ms. Baglivo has extensive knowledge and experience in the fields of brand strategy, marketing, advertising, strategic communications, and general business operations. Ms. Baglivo previously served as Chair and Chief Executive Officer for the Americas at Saatchi & Saatchi Worldwide from 2008 to 2013, and Chief Executive Officer for New York from 2004 to 2008. Prior to joining Saatchi & Saatchi, Ms. Baglivo was President of Arnold Worldwide from 2002 to 2004 and Chief Executive Officer of Panoramic Communications from 2001 to 2002. Ms. Baglivo currently serves as a director of Host Hotels and Resorts (Nasdaq: HST) and Urban Edge Properties (NYSE: UE). Ms. Baglivo previously served as a director of Ruth’s Hospitality Group (Nasdaq: RUTH) until July 2023 and PVH (NYSE: PVH) until June 2021. Ms. Baglivo’s strategic thinking, marketing, advertising, and executive experience, and trusted board service qualifies her to serve as one of our directors.

Robert Fischhas served as a director since September 2015. Since January 2017, Mr. Fisch serves ashas been the President of RNF Group, a consulting company focused on the assessment and evaluation of retail and other business enterprises, as well as providing mentoring services to existing management of these companies, a position he has held since January 2017.companies. Mr. Fisch is a featured ForbesBooks author, publishing his most recent book “Get A Life – A Roadmap to Rule the World” in January 2023, in addition to “FischTales: The Making of a Millennial Baby Boomer”, published in 2019. In September 2020, he joined the Fashion Institute of Technology (“FIT”) Board. HeBoard of Directors. Mr. Fisch has launched with FIT the Bob Fisch Graduate Student Award Program in addition to being a speaker and mentor to the students. He Mr. Fisch also

8 2024 PROXY STATEMENT | | |  |

served as the President, Chief Executive Officer, and Chairman of the Board of Directors of rue21, inc. (Nasdaq: RUE), a large specialty apparel retailer, from June 2001 until October 2016. Mr. Fisch served as a member of the Board of Directors of The Children’s Place, Inc. (Nasdaq: PLCE) from June 2004 until March 2013. From February 1987 to December 1999, he served as the President of Casual Corner Group, Inc. Mr. Fisch’s strategic business acumen and experience as a corporate director of publicly-tradedpublicly traded retail companies qualify him to serve as one of our directors.

Stanley Fleishman has served as a director since March 2013. Since 2017, Mr. Fleishman has been the Executive Chairman of Jetro/Restaurant Depot Group (“JRD”), a nationwide wholesale cash and carry food service distributor, since 2017, prior to which he held the position of Chief Executive Officer since 1992, and prior to that washe served as its Chief Financial Officer. JRD is a multi-billion-dollar business with 150 wholesale cash and carry locations in 34 states. Mr. Fleishman led the efforts to grow the businessJRD from a local distributor to a national multi-billion-dollar company. Prior to joining JRD, Mr. Fleishman was the Chief Executive Officer of Dion

Stores, a South African retail chain, from 1982 to 1985. He holds an M.B.A. from the Wharton School of the University of Pennsylvania. Mr. Fleishman holds undergraduate degrees in business and accounting. Mr. Fleishman’s broad management expertise and his knowledge of the wholesale and retail industryindustries qualify him to serve as one of our directors.

Thomas Hendrickson has served as a director since March 2015. Mr. Hendrickson was most recently the Executive Vice President, Chief Financial Officer, Chief Administrative Officer and Treasurer for Sports Authority Inc., a sporting goods retailer, from August 2003 until his retirement in February 2014. Prior to joining Sports Authority Inc., Mr. Hendrickson was the Executive Vice President, Chief Financial Officer, and Chief Administrative Officer for Gart Sports Company from January 1998 until the time of its merger with Sports Authority Inc. in August 2003. Mr. Hendrickson is currently alead independent director and the Chairperson of the audit committee of the Board of Directors of O’Reilly Automotive, Inc. (Nasdaq: ORLY) as well as a director and the Chairperson of the audit committee of the Board of Directors of Snap One Holdings Corporation (Nasdaq: SNPO). Mr. Hendrickson’s financial, accounting, acquisition, and business experience qualify him to serve as one of our directors.

Abid Rizvi has served as a director since November 2022. Since 2020, Mr. Rizvi currently serveshas served as the Chief Executive Officer of AriZona Beverages, a position he has held since 2020. HeBeverages. Mr. Rizvi previously held other leadership positions at AriZona Beverages since joining in 2016. Mr. Rizvi also brings over 20 years of experience in consumer investment banking, having served as Managing Director and Head of Consumer and Retail Mergers & Acquisitions at RBC Capital Markets, LLC, from 2014 to 2016, and the Americas Head of Consumer and Head of Consumer and Retail Mergers & Acquisitions at Jefferies, LLC from 2010 to 2014. Mr. Rizvi began his investment banking career at Merrill Lynch & Co. where he rose to the position of Managing Director. HeMr. Rizvi has extensive experience in business operations, mergers and acquisitions, and financings. Mr. Rizvi earned an MBA from MIT’s Sloan School of Management and a Bachelor of Science degree from MIT. Mr. Rizvi’s experience in finance, business leadership and operations, and banking qualify him to serve as one of our directors.

John Swygert has been our President and Chief Executive Officer since December 2019. Prior to this appointment, Mr. Swygert was our Executive Vice President and Chief Operating Officer since January 2018. Mr. Swygert joined Ollie’s in March 2004 as our Chief Financial Officer and was later promoted to Executive Vice President and Chief Financial Officer in 2011. Mr. Swygert has worked in discount retail as a finance professional for over 30 years. Prior to joining Ollie’s, Mr. Swygert was Executive Vice President and Chief Financial Officer at Factory 2-U Stores, Inc. Prior to this, Mr. Swygert held several positions of increasing authority at Factory 2-U Stores, Inc. from 1992, ranging fromincluding Staff Accountant, Assistant Controller, Controller, Director of Financial Planning and Analysis, and Vice President of Finance and Planning. Mr. Swygert also previously worked for PETCO Animal Supplies, Inc. in Business Development and Financial Analysis. HeMr. Swygert served on the Board of Directors of Truck Hero Holdings, Inc., a privately held company, from 2018 through January 2021. Since July 2021, Mr. Swygert has served on the Board of Directors and the Audit Committee of Hillman Solutions Corp. (Nasdaq: HLMN). Mr. Swygert’s extensive industry, company, and operational experience acquired from having served as our Chief Executive Officer since December 2019, and, prior to that, serving as our Chief Operating Officer, Chief Financial Officer, and in other various positions prior to joining Ollie’s, qualify him to serve as one of our directors.

| | | 2024 PROXY STATEMENT 9 |

Stephen White has served as a director since July 2016. Mr. White was most recently the Chief Logistics Officer at Dollar Tree, Inc. (Nasdaq: DLTR) from April 2003 until his retirement in May 2016. Mr. White first joined Dollar Tree in 1994 and was responsible for building the logistics division during his tenure at the company. Prior to joining Dollar Tree, Mr. White served as Director of Transportation and Administration and held various other distribution and transportation positions at Ames Department Stores from 1986 to 1994. Prior to Ames,Before that, Mr. White held several transportation and supply chain positions with a number of companies, including LyphoMed Pharmaceuticals, Eastern Airlines, Incom International, and Shell Oil Company.Company (NYSE: SHEL). Mr. White also consults in the field of global logistics on a part-time basis. Mr. White holds a Bachelor of Science in Business Administration with dual majors in Transportation and Distribution Management, and Finance and Insurance, from Northeastern University. Mr. White’s extensive experience in logistics and financial matters qualify him to serve as one of our directors.

Richard Zannino is our Lead Independent Director and has served as a director since September 2012. Mr. Zannino is a Managing Director of CCMP and a member of the firm’sCCMP’s Investment Committee. Prior to joining CCMP in 2009, Mr. Zannino was Chief Executive Officer and a member of the Board of Directors of Dow Jones & Company.Company (“Dow Jones”). Mr. Zannino joined Dow Jones as Executive Vice President and Chief Financial Officer in February 2001 and was promoted to Chief Operating Officer in July 2002 and to Chief Executive Officer and Director in February 2006. Prior to joining Dow Jones, Mr. Zannino was Executive Vice President in charge of strategy, finance, mergers and acquisitions, technology, and a number of operating units at Liz Claiborne. He originally joined Liz Claiborne in 1998 as Chief Financial Officer. Mr. Zannino serves on the Boards of Directors of Hillman Solutions Corp. (Nasdaq: HLMN), The Estée Lauder Companies Inc. (NYSE: EL), and IAC/InterActiveCorp. (Nasdaq: IAC). Mr. Zannino’s past leadership experience, strong finance and management background in the retail industry and his wide-ranging experience investing in and serving as a director for a diverse group of private and public companies qualify him to serve as one of our directors.

To be elected, each of our nominees must receive the affirmative vote of the holders of a majority of the votes cast with respect to such nominee at the Annual Meeting.

10 2024 PROXY STATEMENT | | |  |

Set forth below are biographical summaries of our executive officers as of May 5, 2023.2, 2024. See “Proposal 1—Election1-Election of Directors” above for information about Mr. Swygert, who serves as our President and Chief Executive Officer.

Name | | | Age | | | Position(s) |

John Swygert | | | | | President and Chief Executive Officer | |

Robert Helm | | | | | Senior Vice President and Chief Financial Officer | |

Eric van der Valk | | | | | Executive Vice President and Chief Operating Officer | |

Kevin McLain | | | | | Senior Vice President, General Merchandise Manager | |

| | | | | |||

Senior Vice President, General Counsel and Corporate Secretary | ||||||

| Larry Kraus | | | 53 | | | Senior Vice President, Chief Information Officer |

Robert Helm has been our Senior Vice President and Chief Financial Officer since October 2022. Prior to joining Ollie’s in 2022, Mr. Helm served as Chief Financial Officer of The Children’s Place, Inc. (Nasdaq: PLCE) (“TCP”), a children’s specialty apparel retailer. After joining TCP in 2016 as Vice President and Controller, he assumed roles of increasing responsibility, leading to his appointment to Chief Financial Officer in 2021. Prior to TCP, he held various finance leadership roles at prominent retailers including Ralph Lauren, Ragrag & Bone,bone, and FreshDirect. Mr. Helm began his career in public accounting and auditing, including at KPMG.KPMG, and is a Certified Public Accountant.

Eric van der Valk has been our Executive Vice President and Chief Operating Officer since May 2021. Prior to joining Ollie’s in 2021, Mr. van der Valk served as President and Chief Operating Officer of Christmas Tree Shops (“CTS”), a discount retailer specializing in seasonal, home decor, consumables, and closeout merchandise. After joining CTS in 2005, shortly after it was purchased by Bed Bath and Beyond, he assumed roles of increasing responsibility, leading to his appointment to Chief Operating Officer in 2018 and President and Chief Operating Officer in 2019. Prior to CTS, he held various financial and merchandising roles at May Department Stores Filene’s and Robinsons-May divisions including VPVice President Planning and Divisional Controller from 1998 to 2005. Prior to this, Mr. van der Valk served as head of store operations for KB Toys.

Kevin McLain has been our Senior Vice President, General Merchandise Manager since May 2014. From May 2011 to May 2014, Mr. McLain was a Senior Vice President with Variety Wholesalers, where he was Senior Vice President, General Merchandise Manager of Hardlines. From January 1997 to May 2011, Mr. McLain held the position of Vice President, Merchandise Manager with Anna’s Linens, a textile and home goods retailer based in Costa Mesa, California. Prior to his position with Anna’s Linens, Mr. McLain served in various managerial roles for the Target Corporation.

James Comitale has been our Senior Vice President, General Counsel since October 2021 and was appointed Corporate Secretary in June of 2022. Prior to joining Ollie’s in 2021, Mr. Comitale was Executive Vice President, General Counsel, and Corporate Secretary at Rite Aid Corporation. Mr. Comitale joined Rite Aid Corporation in 1997, spending more than 23 years in house with the company. Prior to his tenure at Rite Aid Corporation, Mr. Comitale was an attorney in private practice.

Larry Kraus has been our Vice President, Chief Information Officer since February 2017.2017 and was promoted to Senior Vice President in April 2024. Prior to joining Ollie’s, Mr. Kraus served as Vice President of Technology for The Bon-Ton Stores, a regional department store chain, a position he held since March 2008. Prior to this, Mr. Kraus held the position of Divisional Vice President, Technical Services and Operations at the Bon-Ton Stores. Prior to joining The Bon-Ton Stores, Mr. Kraus held various information technology positions at Rite Aid Corporation and Walmart.

Each of our executive officers serve at the discretion of our Board without specified terms of office.

| | | 2024 PROXY STATEMENT 11 |

Pursuant to our Corporate Governance Guidelines and Principles, the Board affirmatively determines whether our directors are independent under the Nasdaq Stock Market (“Nasdaq”) corporate governance listing standards.

During its review of director independence, the Board considers all information it deems relevant, including without limitation, any transactions and relationships between each director or any member of his immediate family and the Company and its subsidiaries and affiliates. As a result of this review and based on the recommendation of the Nominating and Corporate Governance Committee, the Board affirmatively determined that Ms.Mses. Ahlman and Baglivo and Messrs. Fisch, Fleishman, Hendrickson, Rizvi, White, and Zannino are independent directors under the applicable SEC and Nasdaq rules.

Our Board has three standing committees: its Audit Committee, its Compensation Committee, and its Nominating and Corporate Governance Committee. Our Board has adopted charters for each of its standing committees. Current copies of our committee charters are posted on our website at www.ollies.us.www.ollies.us.

Audit Committee

The current members of the Audit Committee are Messrs. Fleishman, Hendrickson (Chair), Rizvi, and White. The Board has determined that Mr. Hendrickson is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K, and the Board is satisfied that all members of our Audit Committee have sufficient expertise and business and financial experience necessary to effectively perform their duties as members of the Audit Committee. Messrs. Fleishman, Hendrickson, Rizvi, and White meet the definition of “independent director” for purposes of serving on our Audit Committee under applicable SEC and Nasdaq rules.

The Audit Committee, among other items: (i) monitors and oversees our accounting and financial reporting processes, and the integrity of the corporate accounting and financial reporting processes and financial information, including financial statements; (ii) oversees and reviews our compliance with legal and regulatory requirements; (iii) oversees our processes relating to risk management, including cybersecurity risk; (iv) oversees our conduct and systems of internal control over financial reporting and disclosure controls and procedures; (v) oversees the annual audit of the Company’s financial statements; (vi) evaluates and recommends the independent registered public accounting firm’s qualifications, engagement, compensation and independence; and (vii) monitors the performance of the Company’s independent registered public accounting firm as well as any other public accounting firm engaged to perform other audit, review, or attest services.

The Audit Committee met four (4) times during Fiscal 2022.2023. From time to time, the Audit Committee acted on matters through written consents. The Audit Committee meets with our independent registered public accounting firm without management present on a regular basis.

Compensation Committee

The current members of the Compensation Committee are Ms. Ahlman and Messrs. Fisch and Zannino (Chair). All members of the Compensation Committee meet all applicablethe independence standards under applicable SEC and Nasdaq corporate governance standards.rules.

The Compensation Committee, among other items: (i) annually reviews, discusses, and approves appropriatethe compensation of our Chief Executive Officer, and oversees and reviews the compensation our other executive officers; (ii) oversees management succession planning;planning with the full Board; (iii) reviews and approves employment arrangements with our executive officers; (iv) oversees and administers equity and non-equity compensation plans and programs; (v) oversees, evaluates, and recommends to the Board appropriate forms and amounts of independent, non-employee director compensation; and (vi) preparesoversees and approves the annual report of the Compensation Committee. As required by applicable SEC rules, it will also recommend to the Board the frequency of the “say-on-pay” vote.

The Compensation Committee also reviews and recommends to the Board the target annual incentive pool, the annual performance objectives for participants, and actual payouts to participants, including the executive

12 2024 PROXY STATEMENT | | |  |

officers. The Compensation Committee has sole decision-making authority with respect to all compensation recommendations for our executive officers, subject to further action of the Board as the Board shall determine.determines in its discretion.

To assist it in performing its duties, the Compensation Committee has the authority to engage outside consulting firms. During Fiscal 2022,2023, our Compensation Committee engaged Pearl Meyer & Partners LLC (“Pearl Meyer”), a compensation consulting firm, to advise on director and officer compensation.

The Compensation Committee met four (4) times in Fiscal 2022. Decisions2023. From time to time, the Compensation Committee acted on matters through written consents. The Board approves decisions regarding executive compensation were approved by our Board after taking into account the recommendations of the Compensation Committee and its members.

Nominating and Corporate Governance Committee

The current members of the Nominating and Corporate Governance Committee are Ms.Mses. Ahlman and Baglivo and Messrs. Fisch, Fleishman (Chair), Hendrickson, Rizvi, White, and Zannino. All members of the Nominating and Corporate Governance Committee meet the applicable independence standards under applicable SEC and Nasdaq corporate governance standards.rules.

The Nominating and Corporate Governance Committee, among other items, oversees the nomination process for candidates to the Board including candidates recommended by stockholders, and filling vacancies consistent with the criteria approved by the Board. The Nominating and Corporate Governance Committee also: (i) reviews the effectiveness of, recommends modifications as appropriate to, and reviews Company disclosures concerning (x) the Company’s policies and procedures for identifying and screening Board nominee candidates;(y) the Company’s process and criteria (including experience, qualifications, attributes, diversity, orand skills in light of the Company’s business and structure) used to evaluate Board membership and director independence, and (z) any policies with regard to diversity on the Board;Board diversity; (ii) reviews disclosures concerning director and nominee’sdirector nominee experience, qualifications, attributes, or skills that led to the decision that each director or director nominee should serve as a director; (iii) reviews the relationships between directors, the Company, and members of management at least annually and recommends to the Board whether each director qualifies as independent; (iv) assesses the appropriateness of a director nominee who does not receive a “majority of the votes cast” at an election of directors continuing to serve as a director and recommends to the Board action to be taken in accordance with the resignation policy set forth in the Company’s Corporate Governance Guidelines and Principles, (v) reviews the appropriate skills and characteristics required of directors in the context of the current make-up of the Board and the needs of the Board given the circumstances of the Company; (vi) reviews periodically the Board and committee structure and leadership and recommends any changes to the Board; (vii) reviews the design ofdesigns new director orientation and continuing education for all directors in conjunction with Company management; (viii) develops the methodology for annual self-evaluations of the Board, its committees, and executive management; (ix) develops the methodology for, coordinates, and oversees annual self-evaluations of the role and performance of the Board and its committees, and management, in the governance of the Company; and (x) reviews periodically the Company’s ESG strategy, initiatives, and policies.

In recommending director candidates, the Nominating and Corporate Governance Committee considers whether the candidates possess the required skill sets and fulfill the qualification requirements of directors as overseen and approved by the Board, including independence, sound judgment, business specialization, technical skills, diversity, and other desired qualities. As discussed below, upon the recommendation of our Nominating and Corporate Governance Committee, our Board adopted a so-calledversion of the “Rooney Rule,” requiring that we, or search firms we engage to recruit directors, must include qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Committee selects director candidates, and adopted a diversity policy for director candidates.

The Company’s Corporate Governance Guidelines and Principles reflect the Board’s commitment to consider diversity of race, ethnicity, gender, age, nationality, education, cultural background, and professional experiences in evaluating Board candidates. Our Nominating and Corporate Governance Committee Charter requires that any search firm that the Company or Nominating and Corporate Governance Committee engages includes qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Committee selects director candidates.

Stockholders may submit recommendations for consideration to the Nominating and Corporate Governance Committee, which will be evaluated using substantially the same criteria as applied to recommendations of

| | | 2024 PROXY STATEMENT 13 |

directors and members of management, by providing the person’s name, and appropriate background and

biographical information by writing to the Nominating and Corporate Governance Committee at Ollie’s Bargain Outlet Holdings, Inc., Attn: The Board of Directors, the Nominating and Corporate Governance Committee, 6295 Allentown Blvd., Suite 1, Harrisburg, Pennsylvania 17112. No potential director nominees were recommended by stockholders in 2022.Fiscal 2023.

To assist it in performing its duties, the Nominating and Corporate Governance Committee has the authority to engage outside consulting firms.

The Nominating and Corporate Governance Committee met four (4) times in Fiscal 2022.2023. From time to time, the Nominating and Corporate Governance Committee acted on matters through written consents.

Our director nominees up for election at this Annual Meeting are recommended to our Board for election by our Nominating and Corporate Governance Committee and nominated for election by the Board.

As noted above, our Board will also consider director candidates recommended for nomination by our stockholders during such times as they are seeking proposed nominees to stand for election at the next annual meetingNext Annual Meeting of stockholders (or, if applicable, a special meeting of stockholders). In general, in identifying and evaluating nominees for director, our Board considers whether the candidates possess the required skill sets and fulfill the qualification requirements of directors approved by the Board, including independence, sound judgment, business specialization, technical skills, diversity, and other desired qualities.

Board Diversity

Our Corporate Governance Guidelines and Principles make explicit that diversity at the Board level is an essential element in supporting the attainment of the Company’s strategic objectives. Our Board believes that diversity of race, ethnicity, gender, age, nationality, education, cultural background, and professional experiences are meaningful for Board function. Our Nominating and Corporate Governance Committee is focused on identifying highly qualified diverse candidates and will consider, among other factors, the extent to which a candidate would result in increased diversity of the Board. The Nominating and Corporate Governance Committee and the Board intends to continue to search for candidates who would enable the Board to become more diverse in terms of gender and ethnicity, and any director candidate so identified who also possesses the required skill sets and fulfills the Board’s established qualification requirements will be presented to the Nominating and Corporate Governance Committee for consideration. Our Board has adopted a so-calledversion of the “Rooney Rule,” requiring that we or search firms we engage to recruit directors must include qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Committee selects director candidates. Since 2020, the Board approved expanding the number of directors on our Board and approved the addition of three new directors, all of whom are diverse in gender or ethnicity.

| | Board Diversity Matrix (as of May 5, 2023) | | Board Diversity Matrix (as of May 2, 2024) | | ||||||||||||||||||||||||

| | Total Number of Directors | | | 8 | | Total Number of Directors | | | 9 | | ||||||||||||||||||

| | | | Female | | | Male | | | Non-Binary | | | Did not Disclose Gender | | | | Female | | | Male | | | Non-Binary | | | Did not Disclose Gender | | ||

| | Directors | | | 1 | | | 7 | | | — | | | — | | Directors | | | 2 | | | 7 | | | — | | | — | |

| | Number of Directors Who Self-Identify in Any of the Categories Below: | | Number of Directors Who Self-Identify in Any of the Categories Below: | | ||||||||||||||||||||||||

| | African American or Black | | | — | | | — | | | — | | | — | | African American or Black | | | — | | | — | | | — | | | — | |

| | Alaskan Native or Native American | | | — | | | — | | | — | | | — | | Alaskan Native or Native American | | | — | | | — | | | — | | | — | |

| | Asian | | | — | | | 1 | | | — | | | — | | Asian | | | — | | | 1 | | | — | | | — | |

| | Hispanic or Latinx | | | — | | | 1 | | | — | | | — | | Hispanic or Latinx | | | — | | | 1 | | | — | | | — | |

| | Native Hawaiian or Pacific Islander | | | — | | | — | | | — | | | — | | Native Hawaiian or Pacific Islander | | | — | | | — | | | — | | | — | |

| | White | | | 1 | | | 6 | | | — | | | — | | White | | | 2 | | | 6 | | | — | | | — | |

| | Two or More Races or Ethnicities | | | — | | | 1 | | | — | | | — | | Two or More Races or Ethnicities | | | — | | | 1 | | | — | | | — | |

| | LGBTQ+ | | | — | | | — | | | — | | | — | | LGBTQ+ | | | — | | | — | | | — | | | — | |

| | Did not Disclose Demographic Background | | | — | | | — | | | — | | | — | | Did not Disclose Demographic Background | | | — | | | — | | | — | | | — | |

14 2024 PROXY STATEMENT | | |  |

Our Board believes periodic board refreshment promotes effective board structure and composition. The Board is elected annually and as of the 2022 annual meeting of stockholders, is no longer classified.declassified. The Board does not have a mandatory retirement age or term limits for directors. The Company reviews each director’s continued role on the Board, and the Board’s composition, annually to ensure the Board continues to generate new ideas and operate effectively. The Nominating and Corporate Governance Committee considers among other items each director’s age and length of tenure when considering Board composition and seeks to maintain a balance of experience and continuity.

Our Nominating and Corporate Governance Committee manages the process of identifying and screening potential director candidates to the Board, including candidates recommended by stockholders and filling vacancies consistent with the criteria approved by the Board. The annual Board and director self-assessment processes are important determinants in a director’s renomination and tenure. In 2020, we electedThe additions to the Board of Alissa Ahlman to our Board, andin 2020, Abid Rizvi in 2022, we appointed Abid Rizvi to our Board, each of whom bringsand Mary Baglivo in 2023, have brought both diversity and demonstrated success in fields critical to our business.

Board Role in Risk Oversight

Our Board, its committees, and management continually monitor the material risks facing our Company, including, but not limited toamong other items, financial risk, strategic risk, operational risk, legal risk, compliance risk, and legal and compliancecybersecurity risk. Management regularly reports to the Board on its activities in monitoring and mitigating such risks. Overall responsibility for risk oversight restsresides with our Board. In addition, the Board may delegate risk oversight responsibility to a particular committee in situations in which risk falls within the committee’s area of focus or expertise.

Our Board believes that for certain areas of risk, our Company is better served by having the initial risk evaluation and risk monitoring undertaken by a subset of the entire Board that is more focused on the issues pertaining to the particular risk.

Compensation Risk

Our Compensation Committee assists the Board in fulfilling the Board’s oversight responsibility relating to the evaluation of compensation risk. The Compensation Committee is aware that compensation arrangements, if not properly structured, may encourage inappropriate risk-taking andrisk-taking. The Compensation Committee, therefore, conducts, annually, aan annual formal review, in conjunction with Pearl Meyer, of all of its incentive programs for executives and employees.management associates. After conducting this review in Fiscal 2023, the Compensation Committee has concluded that our compensation programs are not reasonably likely to incentivize employeeassociate behavior that would result in any material adverse effect onto the Company. Our Compensation Committee assists the Board in evaluating risks relating to our compensation policies and procedures.

ESG Risk

Our Nominating and Corporate Governance Committee assists the Board in fulfilling the Board’s oversight responsibility relating to the evaluation of ESG risk. Our Nominating and Corporate Governance Committee has responsibility under the Nominating and Corporate Governance Committee Charter to review ESG risk and develop strategy as we continue to evolve our responses in this area.

Enterprise Risk Level Management

Our Audit Committee assists the Board in fulfilling the Board’s oversight responsibility relating to the evaluation of financial, regulatory, legal, cyber, and other enterprise level risks confronting the Company. Our Chief Information Officer reports and updates our Audit Committee quarterly on all activities and initiatives that our information technology (“IT”) security and compliance team undertakes to monitor and secure our enterprise communications, systems, and assets from external and internal threats. Our Audit Committee, our Chief Information Officer, and management as necessary regularly update our Board on IT and information security matters.

The Company also has a management level enterprise risk management committee that meets quarterly and reports to the Audit Committee. Our Chief Information Officer is a member of this committee and regularly

| | | 2024 PROXY STATEMENT 15 |

reports on both the proactive and other activities that our IT security and compliance team undertakes to monitor

and secure our communications, systems, and assets, and also details and reports on the various training and compliance programs that it develops and maintains for individual users and groups within our workforce, together with the delivery and results of these training sessions.

The Company, among other items: (i) undergoes an annual IT risk assessment performed in accordance with top industry security standards,standards; (ii) is audited and certified annually for payment card industry compliance,(“PCI”) compliance; (iii) undergoes annual internal and external penetration testing,testing; and (iv) undergoes annual web application and mobile application penetration testing. This testing and certification is performed by aA recognized cybersecurity testing and auditing firm. firm performs this testing and certification.

The Company also subscribes to an industry leading IT cybersecurity rating service that provides us with an ongoing IT security rating which, among other items, allows us to analyze and enhance our IT security rating and compare it to certain peers in our industry. The Company regularly assesses and tests the Company’s policies, standards, processes, and practices that are designed to address cybersecurity threats and incidents. These efforts include a wide range of activities, including audits, assessments, tabletop exercises, threat modeling, vulnerability testing, and other exercises focused on evaluating the effectiveness of our cybersecurity measures. The Company regularly engages third parties to perform assessments on our cybersecurity measures, including information security maturity assessments, audits, and independent reviews of our information security control environment and operating effectiveness. Reports regarding the results of such assessments, audits, and reviews are presented to the Company’s risk management committee and the Audit Committee on a quarterly basis, and the Company adjusts its cybersecurity policies, standards, processes, and practices as necessary based on the valuable information gleaned during these assessments, audits, and reviews.

As it deems necessary, the respective committee to which oversight and monitoring of a particular risk has been assigned reports on risk exposures and mitigation strategies with respect to such risk to the entire Board.

Our Board understands there is no single, generally accepted approach to providing Board leadership and that given the dynamic and competitive business environment in which we operate, the appropriate leadership may vary as circumstances warrant. The Board has appointed Richard Zannino as our Lead Independent Director. The Board reviews thisthe appointment of the Lead Independent Director periodically. The Board continues to consider the appointment of a Chair to the Board and the appropriate leadership structure for the Board going forward.

Our Lead Independent Director is appointed by the independent members of our Board, with the following responsibilities:

Presiding at all meetings of the Board, including executive sessions of the independent directors;

Serving as liaison between the Chief Executive Officer and the independent directors;

Together with management, approving information sent to the Board;

Together with management, approving meeting schedules to assure that there is sufficient time for discussion of all agenda items;

Calling and chairing meetings of the independent directors; and

If requested by major stockholders, ensuring that he is available for consultation and direct communication.

It is our policy that each director must be prepared to devote the time required to prepare for and attend Board meetings and fulfill theirhis or her responsibilities effectively. Our directors may not serve on more than four other public company boards,board of directors, but none of our directors currently serves on more than three other public company boards.board of directors.

16 2024 PROXY STATEMENT | | |  |

our directors attended 100%at least 75% of (i) the total number ofaggregate meetings of the Board (held duringand the period for which she or he has been a director); and (ii)committees of the total number of meetings held by all committeesBoard on which he or shethey served (duringduring Fiscal 2023. Additionally, the periods that he or she served).independent directors regularly met in executive session without the presence of management in Fiscal 2023. The Lead Independent Director chairs these executive sessions of the independent directors.

We do not, as a general matter, require the members of our Board members to attend our annual meetings of stockholders. Ms. Ahlman and Messrs. Fisch, Fleishman,None of the members of our Board, other than Mr. Swygert, and White attended the 20222023 annual meeting of stockholders.

Stockholders and other parties interested in communicating directly with the Board as a group may do so by writing to the Board, c/o Ollie’s Bargain Outlet Holdings, Inc., 6295 Allentown Boulevard, Suite 1, Harrisburg, Pennsylvania 17112. The Company’s General Counsel will review all correspondence and forward to the Board all such

correspondence that, in the opinion of the General Counsel, deals with the functions of the Board or committees thereof or that the General Counsel otherwise determines requires Board attention. Concerns relating to accounting, internal controls, or auditing matters will immediately be brought to the attention of the Chairman of the Audit Committee. We have adopted a Whistleblower Policy (and implemented a Whistleblower Hotline), which establishes procedures for submitting these types of concerns, either personally or anonymously, through the submission of a recorded message or written statement to a dedicated hotline communication phone number and site hosted by an independent third party with messages or statements immediately made available to the Company’s General Counsel orand the Chair of the Audit Committee. Also, during each Audit Committee meeting, management updates the committee regarding the status of messages and statements left during the fiscal quarter.

Stockholders and other parties interested in communicating directly with Mr. Hendrickson, as ChairmanChair of the Audit Committee, may do so by writing to Mr. Thomas Hendrickson, Chairman,Chair, Audit Committee, c/o Ollie’s Bargain Outlet Holdings, Inc., 6295 Allentown Boulevard, Suite 1, Harrisburg, Pennsylvania 17112.

We have Corporate Governance Guidelines and Principles.Principles that the Board adopted to serve as a flexible operating framework for the Board and its committees. These guidelines outlinecover a number of areas including the role of our Board, the compositionsize and operating principlescomposition of our Board, Board membership criteria and its committees, and our Board’s working process. The guidelines are reviewed periodically and updated as necessary. Our Corporate Governance Guidelines and Principles are posted on our website at www.ollies.us.www.ollies.us.

Delinquent Section 16(a) Reports

To the Company’s knowledge, based upon a review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company believes that during 2022,Fiscal 2023, all filing requirements applicable to the Company’s officers, directors, and greater than 10% beneficial owners pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) were complied with, except for one latea Form 4 filed on May 5, 2023, for Eric van der ValkBoard member Stanley Fleishman to report the grantexercise of restrictedcertain options and the sale of some of the resulting common stock units in June 2022.that occurred on April 20, 2023.

Our top priorities in responding to current ESG conditions continue to be the safety and well-being of our associates and customers. While doing so, we have focused on ESG opportunities as we look to continue sustainable and responsible growth. The Company has taken a variety of steps to strengthen its commitment to advancing ESG initiatives: The very nature of our business sets us up to be a leader of sustainability in the retail industry. Our model provides a viable marketplace for merchandise that otherwise may have needlessly been discarded by other retailers, while simultaneously offering Real Brands and Real Bargain prices to our customers.

Energy-Saving Initiatives

The Company seeks to positively impact the environment through initiatives for the reduction of energy consumption, such as replacing less efficient lighting with more energy efficient LED lighting. Currently, a majority of our retail stores contain LED lighting, and our goal is to implement LED lighting in all of our retail

| | | 2024 PROXY STATEMENT 17 |

stores in the coming years. We also have implemented an energy management system in most of our stores. This system allows us to operate the energy systems of all stores from a centralized location, so we can more efficiently diagnose issues, monitor energy needs, and optimize energy usage.

Environmental Concerns

Ollie’s is committed to conducting business in an environmentally sound manner based on scientific understanding, customer needs, and local requirements. Directors, officers, and associates are required to comply with all applicable health, safety, and environmental laws and regulations, and all related policies adopted by the Company. Further, we take efforts to minimize the environmental impact of our business, including through the implementation of a chain-wide recycling programs that divert thousands of tons of cardboard from the landfill each year.

Equal Employment Opportunity Policy

The Company also seeks to build a diverse and inclusive workplace where we can leverage our collective talents, striving to ensure that all associates are treated with dignity and respect. We are committed to provideproviding equal employment opportunities and advancement consideration to all individuals and provideproviding a working environment that is free of intimidation, or harassment.harassment, and retaliation. Ollie’s is an equal opportunity employer and has established an Equal Employment Opportunity Policy affording equal employment opportunities to associates and applicants without regard to race, color, religion, sex, sexual orientation, gender identification, national origin, age, disability, genetic information, or any other characteristic protected under applicable law. The same policy prohibits discrimination, harassment, and harassmentretaliation of any type.

Associate Training and Development Programs

We offer a compelling work environment with meaningful experiences, and growth, and career-development opportunities. This starts with the opportunity to do challenging work and learn on the job and is supplemented by programs and continuous learning that help our team build skills to advance. We also provide internal leadership development programs designed to prepare our high-potential team membersassociates for greater responsibility. Our Ollie’s Leadership Institute (“OLI”) is a program that equips field associates with the ability to advance their career.careers. Each OLI participant receives an individual development plan, designed to prepare them for their next level position. We believe our training and development programs help create a positive work environment and result in stores that operate at a high level.

We encourage a promote-from-within environment when internal resources permit. Reflecting our belief in our “home grown” talent, OLI is our preferred source for new supervisors and team leaders. In 2023, over 45% of our current district team leaders were internally promoted to their position. Company-wide, over 60% of our field positions were filled by internal promotions. We believe our training and development programs help create a positive work environment and result in stores that operate at a high level. In Fiscal 2022,2023, Ollie’s filled approximately 55%45% of current store management positions, and approximatelycompany-wide, over 60% of current district team leader and market team leaderour field positions throughwere filled by internal promotions. Our current team of district managers and store managers have an average tenure of approximately six7.4 years and four4.8 years, respectively. We believe internal promotions, coupled with the hiring of individuals with previous retail experience, will provide the management structure necessary to support our long-term strategic growth.

18 2024 PROXY STATEMENT | | |  |

Core Values Campaign

In Fiscal 2022,2023, we launched a campaign describingcontinued to promote and foster the Company’s core values of the Company (the “Ollie’scampaign (that was introduced in Fiscal 2022) (“Ollie’s Core Values”) andwhich established guidelines to assist team membersassociates in acting and thinking in furtherance of the Ollie’s Core Values. We are committed to building and maintaining a strong culture to drive performance, and the Ollie’s Core Values provide a framework for how we think and act as an organization. The current Ollie’s Core Values are as follows:are:

In January of 2024, we officially launched the thrillOllie’s Culture Committee, a group of shopping for incredible bargains in a funassociates selected across the organization who collaborate to bring the Core Values to life throughout the Company, including integrating the Core Values into day-to-day operations at the Company’s store support center and quirky way.driving associate satisfaction, engagement, and retention.

Compensation and Benefits

We are committed to providing market-competitive compensation for all team members.associates. Eligible team membersassociates participate in one of our various bonus incentive programs, which provide the opportunity to receive additional compensation based upon store and/or Company performance. In addition, we provide our eligible team membersassociates the opportunity to participate in a 401(k) retirement savings planplan. Beginning in Fiscal 2023, the Company enhanced the value of this retirement benefit by electing to make the 401(k) Plan a “safe harbor” 401(k) Plan. Effective January 1, 2024, we provide each eligible associate with a Company-sponsored match.an immediately-vested 100% Company match of the

| | | 2024 PROXY STATEMENT 19 |

first three percent of each eligible associate’s contribution to the 401(k) Plan and 50% of the next two percent of each eligible associate’s contribution to the 401(k) Plan. We also share in the cost of health insurance provided to eligible team members,associates. In Fiscal 2023 we switched insurance providers and team memberswe continue to optimize programs for the benefit of our associates. In Fiscal 2023, we switched health insurance providers and we continue to optimize programs for the benefit of our associates. We also provide both our full-time and part-time associates with paid time off, and all associates receive a discount on merchandise purchased from the Company. We also provide both our full-time and part-time team members with paid time off.

Workplace Health and Safety

We strive to maintain a safe and secure working environment and have established safety training programs. This includes administering an occupational injury- and illness-prevention program, and an employeeassociate assistance program for team members.program.

We continue to monitor the impact of the COVID-19 pandemicongoing and potential future pandemics, and other health- and safety- related events, on our business, including on our associates, customers, business partners, and supply chain. We are committed to maintaining a safe work and shopping environment.environment and continue to plan for appropriate responses to future health and safety challenges.

Ollie’s Cares: National Partnerships and Local Community Support